2025 52 Card Project: Week 44: Risk

Nov. 7th, 2025 12:47 pmI have had to do waaaaaaaaayyyyy too much adulting this week.

I've been thinking about the fact that modern daily life involves an unavoidable level of risk.

People get sick.

Car accidents happen.

A passerby might slip on one's property and decide to sue.

Society has developed a way to deal with these risks by creating the concept of insurance. Spreading the risk out to a pool of people makes an ugly surprise much less catastrophic than it might be.

But this past week, an immense amount of work has gone into administering my risk management.

I have mentioned that I am going to retire soon, partly due to the fact that I have in the past year had a Significant Birthday. For various reasons, I had to change my personal insurance arrangements.

But it did not go smoothly, bureaucracies being what they are.

I have had a number of problems with doctors' bills since the Very Significant Birthday when my insurance changed, but I paid the extra money demanded and grumbled but did not think much about it. I had to cancel a dentist appointment because the insurance information was incorrect.

But I hadn't really buckled down to get at the root of the problem until now.

I had an appointment arranged with my doctor this week, but when I did the pre-check in with my doctor's office, I found that they had a company listed for my insurance that I had never even heard of before.

I am not going to bore you with the bureaucratic details (it would take much, much too long to explain), but the upshot was that I was on the phone with six different insurance entities this week, trying to straighten out various problems.

Being an adult really sucks sometimes.

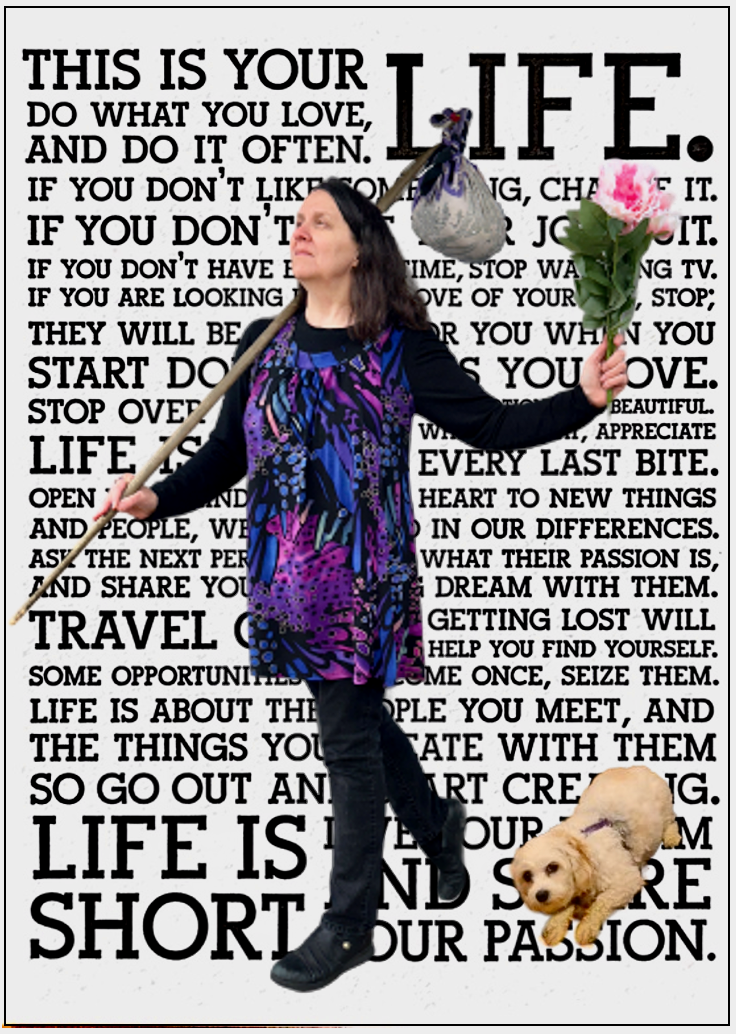

Image description: Central image: a woman leaps into space with her outstretched arms and legs shading into color that suggests movement. Top and bottom: names of various insurance entities: Medicare, State Farm, Further, Portico, Delta Dental, and AmeriHealth.

Risk

Click on the links to see the 2025, 2024, 2023, 2022 and 2021 52 Card Project galleries.

I've been thinking about the fact that modern daily life involves an unavoidable level of risk.

People get sick.

Car accidents happen.

A passerby might slip on one's property and decide to sue.

Society has developed a way to deal with these risks by creating the concept of insurance. Spreading the risk out to a pool of people makes an ugly surprise much less catastrophic than it might be.

But this past week, an immense amount of work has gone into administering my risk management.

I have mentioned that I am going to retire soon, partly due to the fact that I have in the past year had a Significant Birthday. For various reasons, I had to change my personal insurance arrangements.

But it did not go smoothly, bureaucracies being what they are.

I have had a number of problems with doctors' bills since the Very Significant Birthday when my insurance changed, but I paid the extra money demanded and grumbled but did not think much about it. I had to cancel a dentist appointment because the insurance information was incorrect.

But I hadn't really buckled down to get at the root of the problem until now.

I had an appointment arranged with my doctor this week, but when I did the pre-check in with my doctor's office, I found that they had a company listed for my insurance that I had never even heard of before.

I am not going to bore you with the bureaucratic details (it would take much, much too long to explain), but the upshot was that I was on the phone with six different insurance entities this week, trying to straighten out various problems.

Being an adult really sucks sometimes.

Image description: Central image: a woman leaps into space with her outstretched arms and legs shading into color that suggests movement. Top and bottom: names of various insurance entities: Medicare, State Farm, Further, Portico, Delta Dental, and AmeriHealth.

Click on the links to see the 2025, 2024, 2023, 2022 and 2021 52 Card Project galleries.